The event brought together more than 30 experts, including owners and senior managers from industrial companies, bankers and government representatives. The forum discussed tools for creating a competitive industrial sector for the future, ranging from the relocation of production and financing of new workshops to partnerships with the government and attracting migrants.

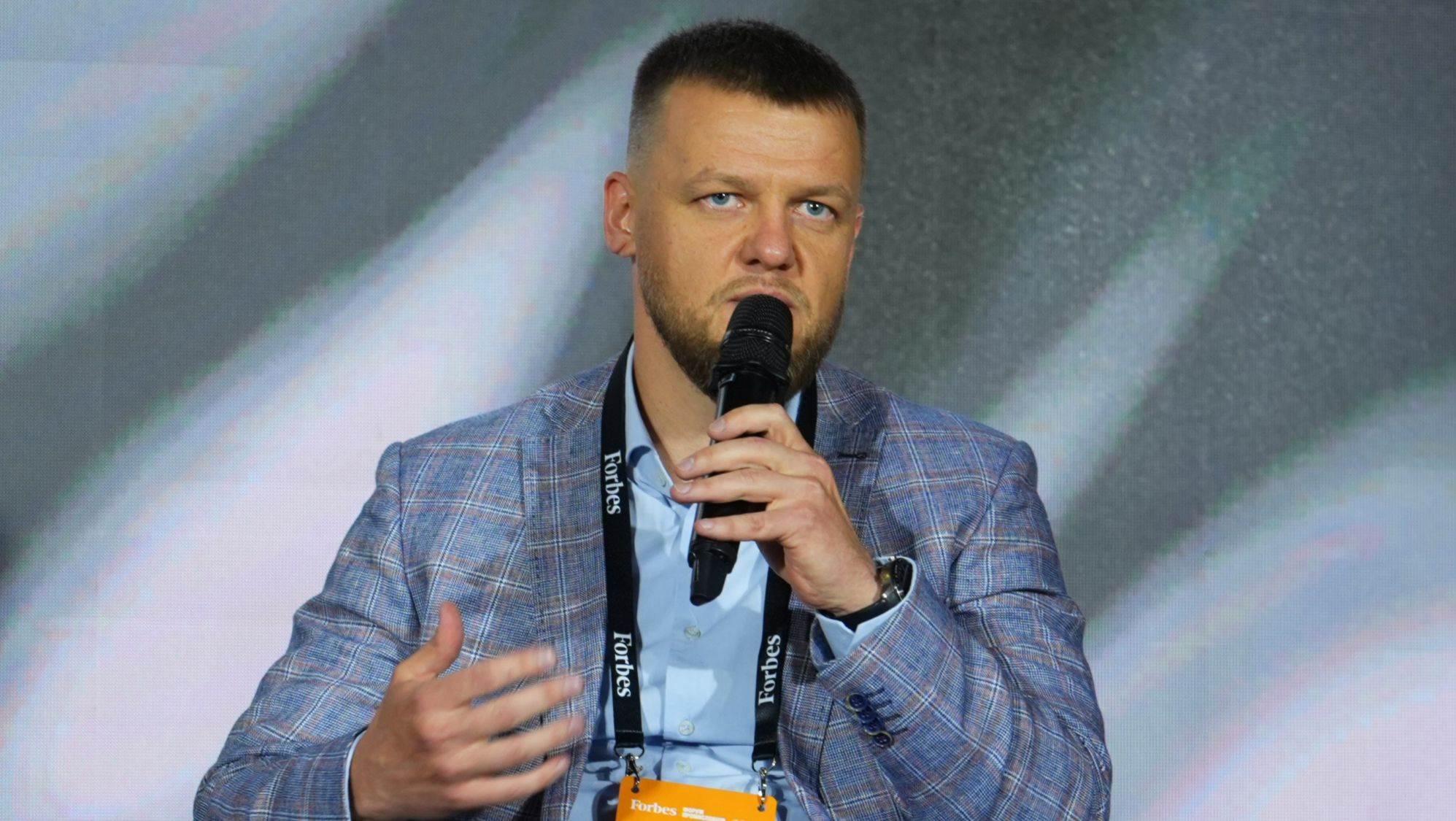

Myronenko took part in the “Doubling the Share of Manufacturing in the Economy: Challenges, Ideas, Solutions” panel. The discussion featured executives from Ukraine’s Ministry of Economy, Environment and Agriculture, the Federation of Employers, Ukrainian Railways and Eurogold Industries.

Metinvest’s COO said that the Group has been restructuring since the start of the war, seeking new ways to organise production and rebuild logistics due to the loss of its Mariupol assets and Avdiivka Coke, as well as the suspension of operations at Pokrovske Coal.

He provided a positive assessment of the Group’s partnership with the state, highlighting the significant number of joint programmes and the well-established cooperation with the government in addressing issues critical to large industrial businesses. In particular, the industry faces many challenges that will determine working conditions in the near future.

CBAM

The Carbon Border Adjustment Mechanism (CBAM), which will come into force in January 2026, will set the conditions for the introduction of additional duties on Ukrainian steel products.

Myronenko said: “This will make us less competitive. Therefore, we are currently working with the government to delay the implementation of CBAM for Ukraine. This would allow us to resume production after the war, make the necessary investments, modernise our enterprises and meet the EU’s environmental standards and requirements for green steel production. This issue is currently the primary concern for the industry, and we hope that, through joint efforts, we will be able to secure a postponement.”

Protecting the Ukrainian market

The second challenge is also related to the introduction of CBAM: many manufacturers will lose the ability to export their products to the EU on preferential terms. And now it is also necessary to prepare to protect the domestic market from imports.

In particular, Ukraine will become one of the most attractive markets for Turkish producers of steel coil. Metinvest’s COO noted: “This could lead to a significant influx of Turkish products, which would greatly limit the development of the Ukrainian market and opportunities for our enterprises to operate. Therefore, we must protect domestic producers and the jobs that they create.”

Scrap exports

The third issue facing the industry is the uncontrolled export of scrap. At the beginning of the war, export volumes were 4,000 tonnes per month, but now they have risen to 50,000 tonnes.

Myronenko believes: “This is a serious threat, as with every tonne of exported scrap, Ukraine loses approximately US$800–900 in foreign currency revenue. These funds could stay in the economy if the scrap were processed at Ukrainian enterprises and sold on the domestic market or exported as finished products, creating new opportunities for the development of national producers.”

High monopoly tariffs

Another problem for all businesses in Ukraine is the tariffs imposed by state monopolies.

He said: “We are in constant dialogue on this issue. Of course, I understand the need for tariff increases, but such decisions must consider the interests of large businesses, ensuring that private companies are not supporting the inefficiency of state enterprises. It is important to find compromises and work together towards resolving this problem.”

Staff shortages

The next challenge facing Ukrainian companies is staff shortages.

Myronenko noted: “The staff shortage at our enterprises is around 15–20%. This is compensated by overtime, weekend work and the involvement of contractors. Currently, this issue remains unresolved, as mobilisation is necessary to maintain the country’s defence capability, but at the same time, it limits our ability to increase production.”

Investment recovery

Despite these challenges, the Group has managed to adapt to the current conditions: Metinvest's metallurgical enterprises are operating at 75% of their pre-war capacity.

He stated: “We have effectively restored large-scale investment in our Ukrainian facilities. This year, we invested US$20 million in repairing a blast furnace at Kamet Steel and are constructing a waste thickening plant at the Northern Iron Ore, which will ensure its operation for decades to come. A substantial investment programme aimed at the restoration of the Ukrainian assets is planned for next year. Therefore, we are not stopping and are confident that, together, we will find solutions for all the outstanding issues and will continue to develop Ukrainian production.”

Prerequisites for increasing production

Metinvest’s COO said that it is too early to talk about doubling production.

Myronenko explained: “We clearly understand that we can exploit the 25% of production capacity that is currently underutilised in the metals segment. To do this, we need to restore two blast furnaces, which will require hundreds of millions of dollars in investment, and we are awaiting access to external financing markets.”

Meanwhile, in the mining segment, the situation is as follows: three out of four plants are operating at 100% capacity, having reached pre-war levels.

He added: “However, Inhulets Iron Ore is currently unable to operate due to high electricity tariffs, which make it uncompetitive on the international market. We have a clear plan for restoring production, but it is essential to work jointly with the government to create the right conditions for the plant’s restart. This will add at least 12 million tonnes of iron ore for export, ensure tax revenue and create around 2,000 jobs in Kryvyi Rih.”

Metinvest’s COO said that these are the short-term, priority tasks. As for the long-term prospects, they include a large investment programme to refurbish the metallurgical enterprises for green steel production, which will be implemented after the war ends.